Private Health Insurance – Benefits, Drawbacks & Is It Worth It?

Private health insurance is a hot topic in Australia. While Medicare provides excellent public healthcare, many Australians choose to take out private cover for extra choice, faster treatment, and peace of mind. But with rising premiums, is it really worth it for everyone? Let’s explore the pros, cons, and key considerations before you decide.

Benefits of Private Health Insurance

1. Greater Choice of Providers & Hospitals

With private cover, you can choose your own doctor, specialist, and hospital — both public and private. This flexibility can lead to a more personalised healthcare experience.

2. Access to Extra Services

Extras cover helps with services Medicare doesn’t include, such as dental, optical, physiotherapy, and chiropractic care, reducing out-of-pocket expenses.

3. Shorter Waiting Times

Private patients usually get faster access to elective surgeries and specialist care. For example, public system wait times for some surgeries can stretch to months, while private cover can mean treatment in weeks.

4. Tax Savings

If you earn above $97,000 (single) or $194,000 (couple/family), having hospital cover helps you avoid the Medicare Levy Surcharge, saving you 1–1.5% in extra tax. Refer to the Medicare Levy Surcharge example below.

5. Government Rebates & Discounts

Most Australians receive a rebate of 8–32% on premiums, depending on income and age. Young adults can also get up to a 10% discount on hospital cover. You can read more about this below.

6. Avoid Lifetime Health Cover Loading

If you take out hospital cover before age 31, you avoid a 2% premium loading for each year you delay — a big cost saver in the long run.

7. Peace of Mind

Knowing you have access to private care when needed can be reassuring, especially for families or those with ongoing health needs.

Disadvantages of Private Health Insurance

1. High Premiums

Hospital + Extras cover can cost from $90 to $850 per month. Premiums also typically rise each year on 1 April.

2. You Still Pay Out-of-Pocket

Co-payments and excess fees often apply, meaning your insurer won’t cover 100% of costs.

3. Complex Fine Print

Policies can be full of exclusions, limits, and waiting periods. Understanding exactly what’s covered can be tricky.

4. Limited or Restricted Coverage

Basic tier policies may only partially cover certain treatments or limit you to shared rooms in public hospitals.

5. Waiting Periods

Most policies require waiting periods — up to 12 months for pregnancy and pre-existing conditions, and shorter periods for other treatments.

6. Breaks in Cover Cost More Later

If you let your policy lapse for more than two years and 364 days, you may face higher premiums later due to Lifetime Health Cover rules.

7. Provider Restrictions

Some insurers only give full benefits if you use their network hospitals and specialists.

The Private Health Insurance Rebate

The private health insurance rebate is a government payment that helps reduce the cost of your premiums.

You can receive it:

-

Directly through your insurer as a reduced monthly premium, or

-

As a tax offset when you lodge your annual tax return.

Rebate Tiers (2024–25)

| Tier | Singles Income | Families Income* | Rebate Age < 65 | Rebate Age 65–69 | Rebate Age 70+ |

|---|---|---|---|---|---|

| Base Tier | $97,000 or less | $194,000 or less | 24.608% | 28.710% | 32.812% |

| Tier 1 | $97,001–$113,000 | $194,001–$226,000 | 16.405% | 20.507% | 24.608% |

| Tier 2 | $113,001–$151,000 | $226,001–$302,000 | 8.202% | 12.303% | 16.405% |

| Tier 3 | $151,001+ | $302,001+ | 0% | 0% | 0% |

*Family thresholds increase by $1,500 for each dependent child after the first.

If your income changes during the year and you over- or under-claim, it will be adjusted when your tax return is processed.

Example: Rebate Overpaid

Emma has private hospital cover and chooses to get the private health insurance rebate directly through her insurer to reduce her monthly premium.

-

She estimates her annual income for surcharge purposes will be $90,000.

-

Based on that, she qualifies for the Base Tier rebate (24.608% for under 65).

-

Her insurer applies this rate to her premiums all year.

But… Emma’s actual income ends up being $105,000 due to a bonus at work.

-

This moves her into Tier 1 (16.405% rebate).

-

That means she’s received too much rebate during the year.

Impact on Tax Return

When Emma lodges her tax return:

-

The ATO compares her actual income to the rebate tier thresholds.

-

It calculates how much rebate she should have received vs what she actually received.

-

The difference becomes a tax payable amount.

For example:

-

Annual premium: $2,000

-

Rebate she got: $492 (24.608%)

-

Rebate she should have got: $328 (16.405%)

-

Overpayment: $164

The ATO will add $164 to her tax bill. This could reduce her tax refund or mean she owes money.

Medicare Levy Surcharge: How Much Could You Pay Without Private Hospital Cover?

Earning over $97,000 as a single in Australia? You could be hit with the Medicare Levy Surcharge if you don’t have private hospital cover. Here’s how it works and an example calculation.

What Is the Medicare Levy Surcharge (MLS)?

The Medicare Levy Surcharge is an extra tax applied to higher-income earners who don’t have eligible private hospital cover. It’s designed to encourage Australians to take out private health insurance and reduce pressure on the public hospital system.

The MLS is in addition to the standard Medicare Levy (which is 2% of your taxable income).

Who Has to Pay It?

You may have to pay the MLS if:

-

You’re a single earning over $97,000 per year, or

-

You’re a family/couple with a combined income over $194,000 per year

(Thresholds increase by $1,500 for each dependent child after the first)

The surcharge rate increases with income and ranges from 1% to 1.5%.

MLS Rates for Singles (2024–25)

| Tier | Income | MLS Rate |

|---|---|---|

| Base Tier | $97,000 or less | 0% |

| Tier 1 | $97,001 – $113,000 | 1% |

| Tier 2 | $113,001 – $151,000 | 1.25% |

| Tier 3 | $151,001+ | 1.5% |

Example: A Single Taxpayer Earning $120,000 Without Hospital Cover

Let’s see how much the MLS would cost for a single person on a $120,000 income.

Step 1 – Determine the Tier

-

Income = $120,000 → Falls into Tier 2 (rate 1.25%).

Step 2 – Calculate the MLS

-

$120,000 × 1.25% = $1,500 extra tax.

Step 3 – Add the Standard Medicare Levy

-

Medicare Levy (2% of $120,000) = $2,400.

-

Total Medicare-related taxes = $2,400 + $1,500 = $3,900.

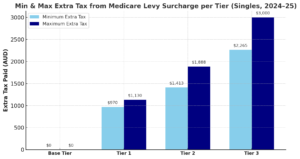

Below is a graph of how much extra you would need to pay if you do not have private hospital cover. Please click on the graph to enlarge it.

How to Avoid the MLS

The simplest way to avoid paying the Medicare Levy Surcharge is to take out eligible private hospital cover. Even a basic policy might cost less than your MLS liability, and you may also benefit from faster treatment times, choice of doctor, and the private health insurance rebate.

Key Takeaways

-

Earning over the threshold without private hospital cover means you’ll pay extra tax.

-

The higher your income, the higher your surcharge rate.

-

Taking out private hospital cover can save you money in tax and provide more healthcare options.

Should you have any questions specific to your situation, contact us at questions@accoladeaccounting.com.au or contact Accolade Accounting on (08) 6263 4466 or (03) 9524 3145 to get further advice.